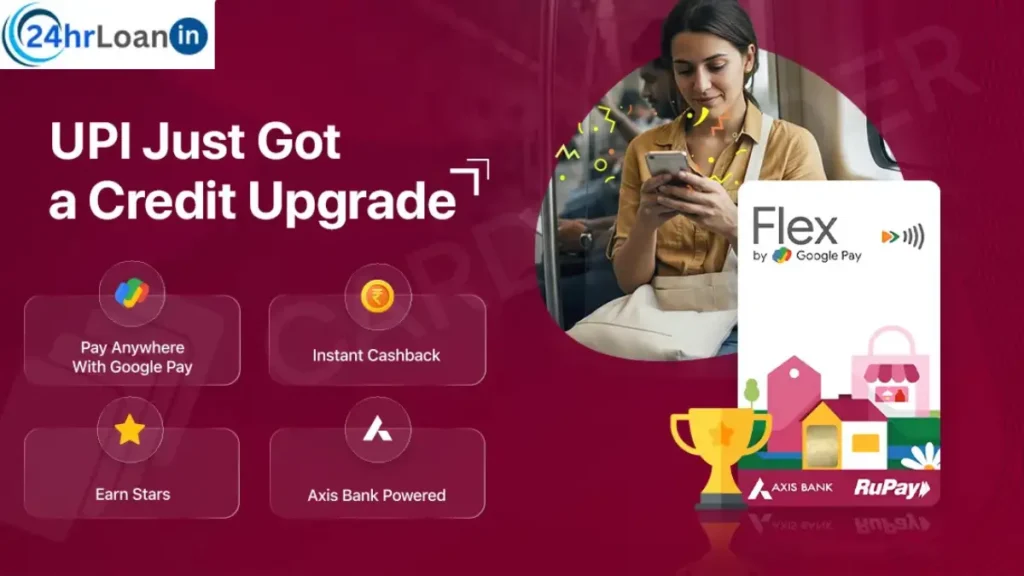

Google has made a big entry into India’s credit market by launching its first-ever credit card globally, starting with India. The card is issued on the RuPay network in partnership with Axis Bank, combining Google’s technology strength with Axis Bank’s banking expertise.

The launch emphasizes simple rewards, digital control, and everyday cashback, avoiding complex point systems.

What is the Google Axis Bank Credit Card?

The Google Credit Card is a digital-first RuPay credit card designed mainly for daily spending, such as:

- UPI payments

- Online shopping

- Bill payments

- Subscriptions

- Offline store purchases

The card is deeply integrated with Google Pay, allowing users to track spending, manage bills, and control card usage directly from the app.

Cashback & Reward on Google Axis Credit Card

Google’s credit card focuses on straightforward cashback, not confusing reward points.

| Spending Category | Cashback (Expected) |

| Google Pay UPI spends | Up to 2% cashback |

| Online shopping & apps | 1.5% cashback |

| Offline merchant spends | 1% cashback |

| Google services (YouTube, Play Store, Google One, Ads)* | Extra cashback / offers |

| Utility & bill payments | Cashback via Google Pay offers |

👉 Key Point: Cashback is expected to be credited directly to the Google Pay balance or statement, making it easy to use.

Welcome Offers of the Google Credit Card

At launch, Google and Axis Bank are expected to offer attractive joining benefits:

Welcome Offers (Expected)

- ₹500–₹1,000 cashback on first spend

- Zero joining fee for a limited period

- Bonus cashback on the first 30–90 days of usage

- Google Pay vouchers

- Discounts on YouTube Premium / Google One plans

Annual Fee & Charge

| Fee Type | Expected Details |

| Joining Fee | ₹0 (Introductory) |

| Annual Fee | ₹499–₹999 |

| Fee Waiver | On minimum annual spend |

| Interest Rate | As per Axis Bank credit card norms |

| Late Payment Fee | As per bank policy |

Google Credit Card UPI + RuPay Advantage

Since the card is on the RuPay network, users receive credit card benefits on UPI payments, which is a significant advantage.

💡 RuPay Credit Card on UPI Benefits

- Pay via UPI using credit limit.

- Accepted at millions of merchants

- Ideal for small daily payments

- Easy tracking in Google Pay

This makes the Google credit card very useful for daily chai-to-shopping expenses.

Also Read: 10 Best Cashback Credit Cards in India

Who Should Use Google Credit Card?

This card is best for:

- Google Pay users

- Young professionals

- First-time credit card holders

- People who want simple cashback, not complex rewards

- Users who prefer digital money management

How This Card Competes with Other Credit Cards

| Feature | Google Credit Card | Traditional Cards |

| Rewards | Simple cashback | Reward points |

| App Control | Google Pay | Bank apps |

| UPI Payments | Yes (RuPay) | Limited |

| Transparency | High | Medium |

| Best For | Daily spending | Category-based users |

Things to Keep in Mind

- Cashback slabs & offers can change

- Interest applies if the full bill is not paid

- Always pay dues on time

- Check Axis Bank T&Cs before applying

Also Read: Best Loan Apps in India with Low Interest for Salaried Person

Conclusion

The Google Credit Card on RuPay with Axis Bank is designed for simplicity, daily rewards, and full digital control. With easy cashback, UPI usage, and Google Pay integration, it could become one of the most user-friendly credit cards in India.

As final cashback slabs and offers are rolled out, users should compare benefits and choose what suits their spending habits best.